By Ashitha Shivaprasad and Daksh Grover

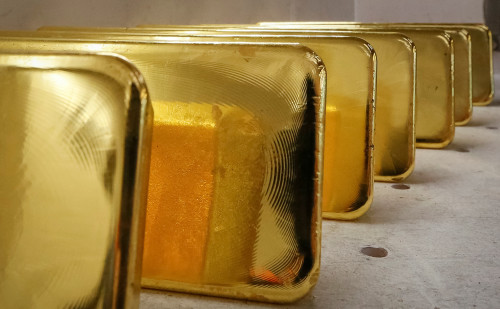

(Reuters) – U.S. President Donald Trump’s latest tariff threats have ignited another gold rush, propelling the safe-haven metal to new heights and bringing the glittering $3,000 milestone into view.

Spot gold climbed to a record $2,911.30 a troy ounce on Monday – its seventh record peak to date in 2025. Prices are already up nearly 11% so far this year after a staggering 27% gain in 2024.

Trump said on Sunday he will introduce new 25% tariffs on all steel and aluminium imports into the U.S., adding that he will announce reciprocal tariffs, applying them to all countries and matching the tariff rates levied by each country.

“Gold is very clearly targeting the $3,000 level and the market is incredibly strong, almost relentless. Now its only a question of when it will scale the level and not if it will,” independent analyst Ross Norman said.

“One should expect to see retracement on profit-taking, but we never do, which reflects that the underlying momentum is very very powerful.”

The tariff plans are broadly viewed as inflationary and capable of sparking trade wars, thereby increasing the demand for safe-haven assets like bullion, traditionally regarded as a hedge against inflation and geopolitical instability.

US PREMIUM

Worry over import tariff plans materialised in U.S. gold futures, with key contracts trading at a premium to the spot price, currently at about $28.

London bullion market players are racing to borrow gold from central banks, which store bullion in London, following a surge in gold deliveries to the United States, sources told Reuters.

“Gold in the Bank of England vault is trading at a discount to the wider market. This has seen week-long queues to withdraw the metal,” said Daniel Hynes, senior commodity strategist, ANZ bank.

Global bullion banks are flying gold into the United States from trading hubs catering to Asian consumers, including Dubai and Hong Kong, to capitalize on the unusually high premium.

Gold in COMEX-approved warehouses stood at 34.60 million ounces, a more than 90% rise since late November, and at their highest level since June 2022.

The London Bullion Market Association also reported on Friday that the amount of gold stored in London vaults fell 1.7% month-on-month to 8,535 metric tons, worth $771.6 billion in January, due to a rush in shipments to the United States.

CENTRAL BANK DEMAND

Analysts and traders have noted that central bank demand will remain robust in 2025 and propel prices further.

Central banks bought more than 1,000 tons of the metal for the third year in a row in 2024, the World Gold Council (WGC) said in a quarterly report.

In the final quarter of 2024, when Trump won the U.S. election, buying by central banks accelerated by 54% year on year to 333 tons, the WGC calculated, based on reported purchases and an estimate of unreported buying.

China’s central bank added gold to its reserves in January for a third straight month, official data showed.

“With the PBoC resuming its bullion purchases in January, along with China’s decision to allow insurance funds to now invest in gold, such moves also appear to bolster bullion’s bullish momentum,” said Exinity Group chief market analyst Han Tan.

China, the world’s biggest bullion consumer, will also allow some of its insurance funds to buy gold for medium- and long-term asset allocations as part of a pilot project, the country’s financial regulator said.

(Reporting by Ashitha Shivaprasad and Daksh Grover in Bengaluru; Editing by Veronica Brown and David Evans)