By Susan Heavey

WASHINGTON (Reuters) -The Republican-controlled U.S. Congress on Sunday sought to push forward with President Donald Trump’s sweeping tax-cut bill, as one of his top economic officials dismissed Moody’s decision to strip the federal government of its top-tier credit rating.

A handful of hardline Republicans blocked the bill from clearing an important procedural hurdle on Friday, saying it did not cut spending sharply enough, with the House of Representatives set to try again in a rare Sunday-night committee session.

Nonpartisan analysts say the bill, which would extend the 2017 tax cuts that were Trump’s signature first-term legislative win, would add $3 trillion to $5 trillion to the nation’s $36.2 trillion in debt over the next decade. Moody’s cited the rising debt, which it said was on track to reach 134% of GDP by 2035, for its downgrade decision.

Treasury Secretary Scott Bessent dismissed the cut’s significance in a pair of Sunday television interviews, saying the bill would spur economic growth that would outpace what the nation owed.

“I don’t put much credence in the Moody’s” downgrade, Bessent told CNN’s “State of the Union” program, echoing White House criticism.

Economic experts, meanwhile, warn the downgrade from the last of the three major credit agencies was a clear sign that the U.S. has too much debt and should prompt lawmakers to either increase revenue or spend less.

Congressional Republicans in 2017 also argued that the tax cuts would pay for themselves by stimulating economic growth. But the nonpartisan Congressional Budget Office estimates the changes increased the federal deficit by just under $1.9 trillion over a decade, even when including positive economic effects.

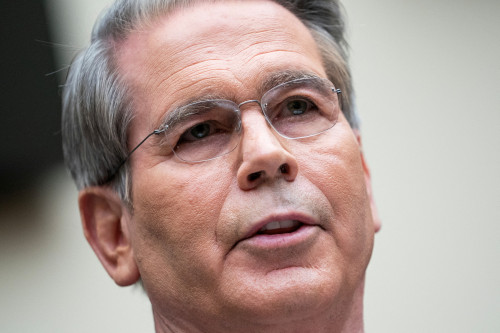

House of Representatives Speaker Mike Johnson on Sunday said the chamber is still “on track” to pass the bill, which the House Budget Committee plans to vote on in a 10 p.m. ET (0200 GMT Monday) hearing.

“We’ve had lots of conversations. We’ll have more today,” Johnson said on “Fox News Sunday with Shannon Bream” when asked about hard-line Republicans, including Representatives Chip Roy of Texas and Ralph Norman of South Carolina, demanding more spending cuts.

MEDICAID CUTS EYED

Trump’s Republicans hold a 220-213 majority in the House and are divided over how deeply to slash spending to offset the cost of the tax cuts.

Hardliners want cuts to the Medicaid health insurance program, a move that moderates and some Republican senators have pushed back against, saying it would hurt the very voters who elected Trump in November, and whose support they will need in 2026, when control of Congress is again up for grabs.

The bill’s cuts would kick 8.6 million people off Medicaid, the joint federal-state program for low-income Americans. It also aims to eliminate taxes on tips and some overtime income —both Trump campaign promises — while also boosting defense spending and providing more funds for Trump’s border crackdown.

Republicans are also at odds over the deductibility of state and local taxes, or SALT, an issue of great significance to a handful of incumbents from states such as New York and California that are critical to the party’s narrow House majority.

Moody’s downgrade, coming amid ongoing economic uncertainty over Trump’s tariffs that have already roiled global markets, could further rattle investors when Wall Street re-opens on Monday.

Trump and his administration have vowed to balance the budget since the Republican president took office again in January.

But his attempts to cut government spending through Elon Musk’s Department of Government Efficiency have fallen far short of its goals. It also remains unclear what revenue would be raised through tariffs as Trump swings between imposing higher rates and cutting deals.

Johnson said the downgrade showed the need for the tax bill.

“Moody’s is not incorrect,” Johnson said. “We’re talking about historic spending cuts. I mean, this will help to change the trajectory for the U.S. economy.”

He aims for the bill to pass the House this week, ahead of the May 26 Memorial Day holiday. Lawmakers face a far harder deadline later this summer, when they will need to address the U.S. debt ceiling or trigger a potentially catastrophic default.

Democratic U.S. Senator Chris Murphy of Connecticut said the credit rating cut spelled trouble for Americans.

“That is a big deal. That means that we are likely headed for a recession,” Murphy told NBC’s “Meet the Press.”

“That probably means higher interest rates for anybody out there who is trying to start a business or to buy a home. These guys are running the economy recklessly.”

(Additional reporting by Katharine Jackson, David Morgan and Davide Barbuscia; Editing by Scott Malone and Bill Berkrot)