By Amina Niasse and Nicholas P. Brown

NEW YORK (Reuters) -Health and wellness companies are embracing weight-loss drugs and building offerings around them in an effort to avoid the fate of WeightWatchers, which declared bankruptcy this week, citing vastly increased use of the new blockbuster medicines.

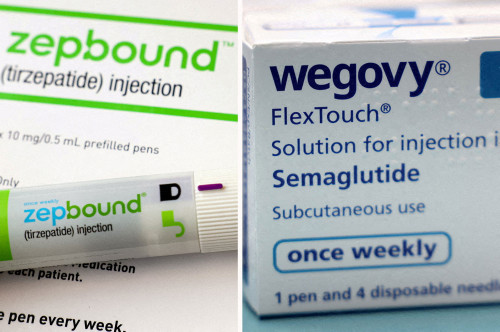

But some of WeightWatchers’ closest rivals, newer telehealth companies, face a new challenge of their own as federal regulators crack down on the cheaper versions of Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound that have become a big part of the companies’ sales. The telehealth companies’ success may ultimately depend on partnering with the name brand drugmakers, one analyst said.

WeightWatchers filed for bankruptcy on Tuesday, as Americans shunned its weight management business in favor of the Novo and Lilly drugs and copies from pharmacies that can cut a person’s weight by 15%-20%. The drugs, from a class of digestion-slowing medicines known as GLP-1 agonists, have eaten into demand at some big companies, including Walmart’s food business.

WeightWatchers, when it filed for bankruptcy, said its weight management system stopped being attractive to customers given changing views about weight versus wellness, competition from telehealth companies fully embracing the weight-loss drugs, and even fitness influencers on TikTok. The company has an agreement with creditors to restructure its debt and quickly exit the court process.

Adam McBride, CEO of Telehealth company Eden, said WeightWatchers, which tried to pivot to telehealth and sell weight-loss drugs, had an old school system that relied on points and in-person gatherings that customers didn’t like. “I don’t think that they were listening to their members,” McBride said.

Eden and rival Noom both operate weight-focused telehealth platforms with integrated lifestyle coaching – something WeightWatchers struggled with.

The newer companies have been selling unbranded versions of the in-demand weight-loss medications as part of their offerings.

Clinical subscriptions that provide access to clinicians and prescription drugs make up over half of Noom’s revenue, said CEO Geoff Cook.

At rival Hims and Hers, compounded weight-loss drugs accounted for 20% of revenue last year, and even WeightWatchers relied partly on such revenue.

Noom presents the drugs as a kind of superpower weight-loss tool, which the company said then drives customers to other parts of its platform.

“In the last month or two, people who are taking the meds are actually logging more meals,” said Noom’s CEO. “They’re weighing in more and they’re engaging in the other aspects of the Noom program at a rate that’s even better than the flagship program.”

WEIGHT-LOSS DRUG BANDWAGON

Other health companies see room for products and services that take advantage of the popularity of new weight-loss drugs, which some analysts forecast will have annual sales of $150 billion in the next decade.

Health retailer The Vitamin Shoppe has seen a spike in demand for supplements that could help with loss of appetite, decreasing muscle tone, and other GLP-1 side effects, said President Muriel Gonzalez. Sales of a set of supplements marketed to people taking such drugs jumped more than 20% from a year ago, a company spokesman said.

Last year, The Vitamin Shoppe launched a telehealth service, Whole Health Rx, that connects consumers with medical providers who can prescribe weight-loss drugs and recommend supplements to give people protein, fiber and multi-vitamins while on them.

Other companies have made similar moves. Supplement-seller GNC, looking to capitalize on the trend, last year added a section in stores dedicated to GLP-1 users, selling protein powder and fiber.

WeightWatchers itself is still trying to pivot. A spokesperson said in a statement that the GLP-1 drugs for weight loss are a growing and essential part of its business. It said its program works, citing an internal study in which its clinic patients taking GLP-1 drugs lost 21% of their weight and then transitioned to its behavioral program and lost another 2% after 13 weeks.

But easy sales of cheaper versions of the drugs are ending, even as lawsuits remain. The U.S. Food and Drug Administration is blocking sales of cheaper compounded versions of the drugs now that Wegovy and Zepbound and their related diabetes medicines — Ozempic and Mounjaro — are no longer in shortage.

Selling cheaper versions of the drugs has been a huge profit driver for these companies, and the loss is an issue, said Morningstar healthcare analyst Karen Andersen.

One path forward for wellness companies is to work with brand name drugmakers, Andersen said.

“Companies like Novo, they need partners that have access to patients,” she said. But finding creative ways to partner with key competitors is no small task, she added. “It will be a rocky path.”

(Reporting by Amina Niasse and Nicholas P. Brown in New York; Additional reporting by Dietrich Knauch in New York; Editing by Peter Henderson, Caroline Humer and Bill Berkrot)