By Howard Schneider

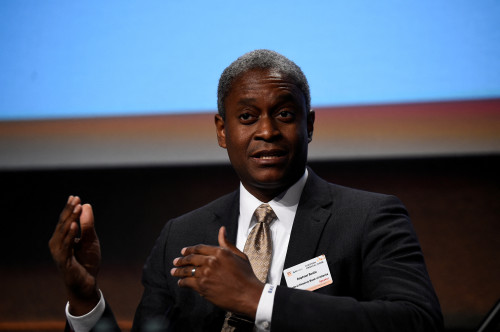

WASHINGTON (Reuters) -Risks to the job market have increased, but it remains too soon to commit to interest rate cuts before the next meeting of the U.S. Federal Reserve with key data still to come and inflation still expected to rise in coming months, Atlanta Fed President Raphael Bostic said on Thursday.

Bostic, in comments to a Florida business group, said he still felt a single quarter percentage point rate cut was likely all that will be appropriate this year, but “we’re actually going to get a lot of data around inflation, around what’s happening in terms of employment, that will allow me to think about…the relative balance of risks between inflation and employment. The employment number did say that the risk on the employment side is much higher than it had been…I will definitely be looking carefully.”

The Fed next meets on September 16-17 and is widely expected to reduce the benchmark policy rate by a quarter of a point after holding it steady in the current 4.25% to 4.5% range for the last five meetings. President Donald Trump has insisted on deep and immediate rate reductions.

Employment growth slowed and the unemployment rate rose in July, and new data from the Bureau of Labor Statistics showed a large downgrade to prior months’ job gains, a development that led Trump to fire the head of the agency.

Bostic said the size of the revisions had led him to rethink his view of the risks facing the economy, but that his concerns about inflation – and the uncertainty about coming tariff impacts – left his policy view unchanged for now. He said it may take until mid-2026 before businesses have fully responded to changes in tariffs, leaving risks to inflation unresolved.

“My outlook for the economy is for it to continue to slow,” Bostic said, but the issue of whether tariffs will cause only a one-time round of price hikes, or lead to more persistent price pressures, “is perhaps the most important question we have today.”

Some on the Fed, and most notably Governor Christopher Waller, a contender to replace current Fed Chair Jerome Powell, have said they don’t see tariffs leading to steady price increases and argue that rates could begin to fall. Waller dissented at the last meeting in favor of a rate cut.

Bostic said he was still concerned the tariff debate could reset public expectations in a way that boosts prices, and also noted that if tariffs do begin to reshape global supply chains away from low-cost producers like China, as the administration says it hopes, it could lead to structurally higher inflation.

“Does the textbook model fit today’s environment?” Bostic said, referring to economic models that show tariffs acting like a tax to change prices once, but not persistently. “I think there are reasons that are pretty compelling that suggest we should be somewhat skeptical about that.”

Still, he said, upcoming data will shape the near-term policy outlook. The Fed will receive new data on consumer prices next week, updates on other inflation measures later in the month, and a jobs report for August before the next policy meeting.

(Reporting by Howard Schneider; Editing by Franklin Paul and Andrea Ricci)