By Davide Barbuscia

NEW YORK (Reuters) -S&P Global Ratings’ decision to affirm its U.S. credit rating factored in tariff revenues, but questions remain on the economic outcome of U.S. trade policies that could influence the country’s rating in the next few years, the primary analyst on the U.S. said.

S&P on Monday affirmed its “AA+” credit rating for the world’s number one economy, saying the revenue from President Donald Trump’s tariffs had the potential to offset the fiscal hit from his massive tax-cut and spending bill. S&P, which became the first ratings agency to cut the pristine U.S. government rating in 2011, said the outlook on the U.S. rating remains stable.

Lisa Schineller, primary U.S. analyst at S&P Global Ratings, said execution and effects of trade and budget policies will be decisive for future ratings.

“The outcomes of how you execute the budgetary legislation, how the tariff revenue comes, their combined impact on growth and investment that leads to either better or worse or similar fiscal out-turns, that’s our focus,” she told Reuters in an interview.

Nonpartisan analysts have said that the bill Trump signed into law last month could add $3.3 trillion to the nation’s debt over the next decade. Republicans have argued that extending and adding to tax cuts implemented during Trump’s first term in 2017 and meant to expire in 2025, will not drive the debt higher.

Schineller said S&P’s forecast horizon when assessing the U.S. creditworthiness was about three, four years.

While she did not expect the tax and spending bill as such to lower the U.S. budget deficit, she said tariff revenues expected over that horizon would offset – to a certain extent – the deficit-widening impact of the budget legislation.

“It is a potentially important offset,” Schineller said.

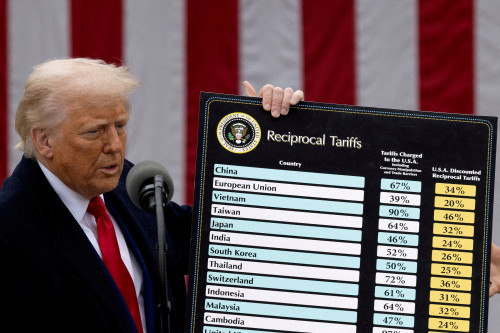

The Budget Lab at Yale, a non-partisan policy research center, estimates the average effective tariff rate has shot up to 18.6% now from 2.4% in early January.

“It’s that large of a change that we feel that will bring in important revenue,” said Schineller.

The U.S. reported a $21 billion jump in customs duty collections from tariffs in July, but the government budget deficit still grew nearly 20% during that month to $291 billion. The U.S. national debt surged above a record $37 trillion last week.

Ratings agency Moody’s in May downgraded the U.S. sovereign credit by one notch, citing rising debt levels and stripping the country of its last triple-A top rating.

That followed a 2023 downgrade by rival Fitch, which pointed to expected fiscal deterioration and repeated down-to-the-wire debt ceiling negotiations.

The passage of the budget law and several trade deals in recent months provided a clear enough picture to affirm the U.S. sovereign rating and outlook, said Schineller.

Going forward, changes in the U.S. fiscal health will be key for further rating actions, which are based on factors including economic and institutional strength, she said.

“The weakest part of the (U.S.) credit story … is the fiscal trajectory,” she said.

(Reporting by Davide Barbuscia; Editing by Chizu Nomiyama and Tomasz Janowski)