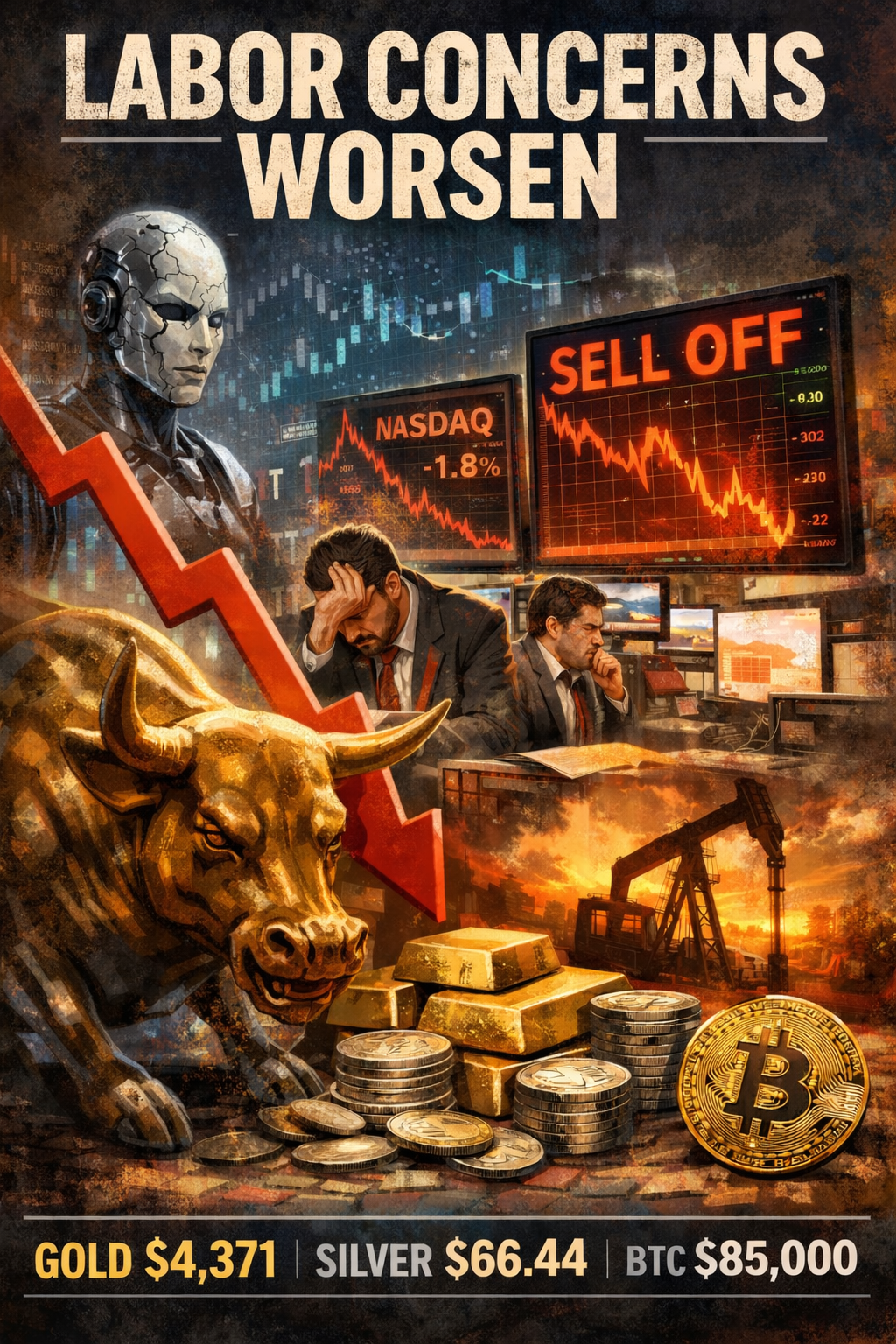

As the week ended the market saw many hot performers hit new highs, only to see Friday’s gains “fall apart.” Worries over the future of all aspects of Artificial Intelligence, and potential profit-making ability overtook the market, as investors backed off. After a stellar week, Friday’s meltdown in the afternoon, of techs, AI and market favorites stalled the market across the board. After Wednesday’s rate cut was announced by the Federal Reserve, jubilant investors and traders piled into the market as stocks advanced. The market initially surged, then began to slip, wiping out early profits. “Under-funding” of Artificial Intelligence stocks gave investors and traders serious reasons to move to the sidelines and or pivot funds to more secure investments such as the precious metals and income bonds. All three indexes were lethargic Monday with the exception of a bright spot… precious metals. Gold is at $4,371, with Silver and Platinum trading at $66.44 and $1,874 respectively. Shiny metals are beneficiaries when market concerns widen and precious metals are popular when investors get skittish of hot market stocks, often turning to safer havens. The metals have been in strong demand around the world in most Global markets. Dev Kantsaria, founder of Valley Forge Capital Management, said: “It’s been very hard not to participate in the high-tech party.”

Monday’s open was on the down side with the indexes struggling to stay even all day. The tech-AI Nasdaq Composite lost 0.6%, while the S&P 500 was off 0.2%. The blue chip Dow Jones Industrial Average finished just below flatline. Gold and silver again headlined the stubborn market adding consistent value. Much delayed Government data, due to the shutdown is due to be released in the next few days. Bitcoin drifted lower as the crypto market has stuttered of late, presently hovering in the $85,000 range.

The Nasdaq dropped dramatically, again Tuesday off 1.8% as investors and traders cranked up concern about the future and success of Artificial Intelligence stocks, and pricing of the high tech sector. Employment figures released Wednesday gave the market a jolt. Delayed numbers were weak, as illustrated by the status of the labor market. Both the Dow Jones, off 302 points and the S&P 500 down 2% suffered. The present unemployment rate of 4.6% is holding steady with the economy adding 64,000 jobs, however in October 105,000 jobs were lost. The government jobs were affected as demand faltered as a result of the ‘shut-down.’ with a good portion to be rehired. “Overall it was a lukewarm data set informing the lukewarm trading on the day,” said David Waddell, chief investment strategist at estate planning firm Waddell & Associates. Wednesday’s market floated lower with AI and techs taking losses.

Crude oil has continued to decline, resting at its lowest level since 2021, at $58.92 a barrel on Wednesday off 2.7%. West Texas Intermediate has fallen to $55.92 a barrel. Serious oil sanctions on Russia oil have crippled the sale to many countries, with a glut of increasing reserves. China’s thirst for oil is straining the country as their economy is being stretched by a severe industrial slowdown and higher tariffs. India has attempted to increase Russian oil purchases, with the U.S. government penalizing the country with high tariffs.”

RUMBLINGS ON THE STREET

Nathan Sheets, global chief economist at CITI, WSJ – “I don’t think inflation is going to break out on the upside, but by the same token you’re not at 20% and there’s no compelling narrative that you’ve going to get back to 2% anytime soon.”

Ryan Detrick, chief market strategist at Carson Group, WSJ – “The market got the cut it wanted, and although a January cut isn’t the base case, by no means did they put cold water on that potential move.

Michael Reynolds, vice president of investment at Glenmere, WSJ – “The Fed has largely landed at a good place.”