Multi exposure of forex chart drawing over us dollars bill background. Concept of financial success markets.

(Justin Vaughn, Editor, Options Trading Report)

Powell turns a bit… ‘hawkish’…. Federal Reserve Chief Jerome Powell sounded more like a hawk this past week…for the first time since late 2018. Appearing before Congress, Powell’ explicitly dropped his prior characterization of inflation pressures as “transitory.” Saying the threat of persistently higher inflation has grown, that the Fed would consider wrapping up asset purchases a few months early. He was clear that his ‘hawkish’ tone didn’t incorporate the emerging risk presented by the Omicron variant which could have major implications for future Fed policies. He indicated that the mission of the Fed’s buy policy shift in 2020 to calm inflation above 2% to make up for prior shortfalls’, had been achieved. He added, and made it clear that he thinks the labor market will be worse off, not better, if elevated inflation continues.

A new Covid variant and the start of the Federal Reserve’s ‘tightening cycle’ are giving investors some serious reasons to worry. Small-cap stocks are already in a correction-and the rest of the market seems close to following. Wall Street’s “fear gauge,” meaning the expectations for market volatility, ‘plunged and soared’ as investors grappled with the new variant. For the week…markets’ fall, caps volatile week. Markets ended a tumultuous week on a perilous note with the broad technology-sector selling off, sending the indices lower, and treasury yields falling at an alarming pace. The Omicron variant of Covid-19 has emerged ‘injecting’ further volatility into the stock market as investors were already weighing rising inflation and direction of the present recovery. “Omicron will absolutely affect growth in the next few months,” said Dev Kantesaria, founder of Valley Forge Capital. The tech-focused Nasdaq Composite ended the week with a 2.6% weekly loss, lagging behind its peers, and concluded its biggest two-week percentage decline since March, ending at 15085. The S&P 500 fell 1.2%, finishing at 4538, while the Dow Jones Industrial Average fell 319 points, or 0.9% to 34580. The small cap Russell 2000, a good barometer with smaller-cap companies, was down 3.9% for the week at 2159. Friday’s monthly jobs report added ‘tarnish’ also, as the report showed that employers added 210,000 jobs in November, well below the 573,000 expected by economists polled by the Wall Street Journal. The unemployment rate declined to 4.2% last month and the share of people either working or looking for work rose, a positive sign for the economy. “On balance I would still rate it as a good report for the economy, despite the fact that the headline looks to be a miss,” said Chriss Zaccarelli, chief investment officer at Independent Advisors Alliance. Mr. Zaccarelli said he thought the report would give the Fed greater confidence that the economy is in fact doing well. Time will tell. Yield on the benchmark 10-year Treasury note fell to 1.342%, recording the biggest one-week yield decline since January 2020. Yields have fallen now for three consecutive weeks. (Yields and prices move inversely).

Turkey’s Turmoil…Turkey’s economy is sliding downward as the lira has lost as much as 45% of its value this year, making ordinary Turks poorer. People here are rushing to trade their shrinking wages for dollars and gold. The pandemic-era consumer price increases that have plagued economies all over the world are big time in Turkey where inflation stands at more than 21%. The crisis largely stems from President Recep Tayyip Erdogan’s own economic policies, say economists both inside and outside Turkey. After nearly two decades in power, Mr. Erdogan has fired nearly every economic officer who has stood in the way of his unorthodox views and failures. He has steered the country down a path to economic destruction. After years in which he has weakened Turkish institutions and centralized power, Mr. Erdogan has now assumed broad control over the economy, with no one within government to oppose him, former Turkish officials say. So far Turkish banks have been able to withstand the currency crisis. But economists are concerned that further collapse of the lira could trigger a bank run, or that Turkey could default on its foreign debts. “We’re living through a different type of crisis,” said Mr. Canakci, the former Turkish treasury official. “This is a crisis of getting poorer.”

Crude oil prices, which fell 0.4% Friday to $66.26 a barrel, finished the week above Thursday lows. Brent crude, the global benchmark, rose 0.3% to $69.88 Friday. Concerns about demand being disrupted by further travel restrictions and lockdowns have dragged down crude roughly 20% from its 2021 highs. The move marked a pause in a slide that began in late November with the emergence of the Omicron variant. Some investors were reassured that lower demand would be met with production cuts. “The pushdown over the week has been sort of oversold,” said Gary Cunningham, director of market research at Tradition Energy. He said he expects U.S. crude oil to hold in the upper $60’s throughout the winter.

RUMBLINGS ON THE STREET

Kevin Harper, Almanack Investment Partners, IBD “The 10-year market expectations for inflation are only marginally higher than they’ve been for the past 20 and 10 years. So, the market is basically saying everything is going to go back to normal.”

Jason Pride, chief investment officer of private wealth at Glenmede, WSJ Mr. Pride said that some fixed income investors were positioning for the Fed to make a policy mistake, or for the central bank to not move “ahead with the pace of rate increases many are anticipating. “Fixed-income markets are moving in the opposite direction of what everyone’s monetary-policy expectations are,” said Mr. Pride. “There’s a little bit of a hint of the market being scared of a Fed mistake.”

Cliff Noreen, head of global investment strategy at MassMutual, Barron’s “Many of these very high-valuation growth stocks were trading a few years ago ahead of underlying fundamentals. The equity market is very quickly repricing sky-high valuations.”

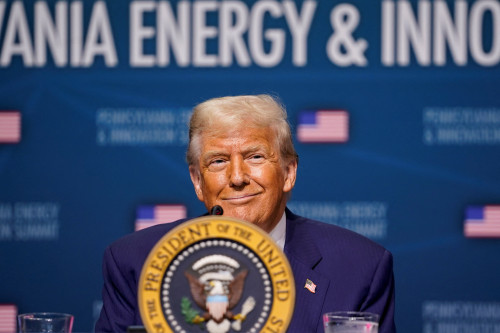

Federal Reserve Chairman, Jerome Powell, in testimony before Congress. Barron’s

“I think it’s probably time to retire that word (transitory) and try to explain more clearly what it means.”

Shane Milkburn, Colorado Springs resident, Barron’s “I owe my retirement security to pension portability. Another term for pension portability is 401(k).”