By Lisa Pauline Mattackal

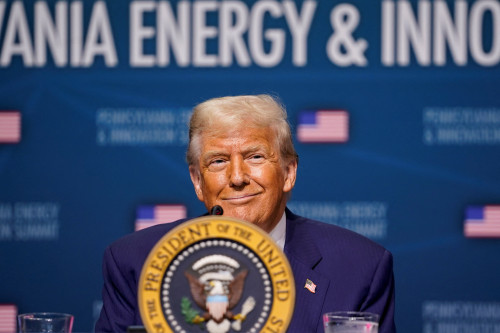

(Reuters) – U.S. small-cap stocks have surged to near record highs following Donald Trump’s presidential election win, but some investors are wary of chasing the rally as they fear his policies could drive a resurgence in inflation, hurting the rate-sensitive sector.

The Russell 2000 index has jumped around 6% since the election on Nov. 5, outperforming gains in major indexes on expectations that Trump’s proposals to cut taxes, decrease regulations and increase tariffs would lift domestically focused small caps.

But some analysts and portfolio managers believe the policies could drive up the cost of goods and stoke inflation, derailing the sector’s performance, particularly if renewed inflationary pressure prompts fewer-than-expected Federal Reserve interest rate cuts.

Investors have already dialed back expectations for rate cuts in 2025, and that has pushed Treasury yields to multi-month highs.

“We think (inflation) is probably the biggest under-appreciated risk by markets,” said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute (WFII), who has a neutral rating on small caps.

“Right now, large caps seem higher quality (and have) better earnings growth, it’s just very difficult to drop down to smalls when they don’t have much going for them right now.”

Small-cap companies tend to carry more debt on their balance sheets, which means an increase in interest rates could drive up borrowing costs for them and make servicing their debt more difficult, analysts say.

Jamie Battmer, chief investment officer at Creative Planning, said Trump’s tariffs would force small caps to face a “delicate balancing act.”

The Russell 2000 has gained about 19% in 2024, however, lagging the benchmark S&P 500’s 26% rise and the Nasdaq’s 28% gain.

Despite the index’s underperformance this year, valuations are high. The Russell 2000 is trading at around 28.3 times forward earnings, according to data compiled by LSEG, compared with S&P 500’s 22.7.

“What we are focusing on is earnings and quality – and small caps don’t really fit that,” said Jim Caron, chief investment officer, cross-asset solutions at Morgan Stanley Investment Management.

Ryan Dykmans, chief investment officer at Dunham & Associates Investment Counsel, said that while his firm has been adding to small-cap holdings, it has focused on companies with less debt.

“If rates are going to stay as high as they are today for another year, you’re going to see a lot of small cap companies just burn out,” said Dykmans, suggesting it would be difficult for them to pay down interest on their debt or take out new loans.

Investors seeking to add small caps are better off waiting for dips rather than buying at current levels, WFII’s Samana said.

(This story has been corrected to say Russell 2000 index ‘jumped around 6% since the election’, not ‘nearly 31%,’ in paragraph 2)

(Reporting by Lisa Mattackal in Bengaluru; Editing by Shinjini Ganguli)