By Max A. Cherney, Arsheeya Bajwa and Stephen Nellis

(Reuters) – Nvidia forecast higher first-quarter revenue on Wednesday, signalling continued strong demand for artificial intelligence chips, and said orders for its new Blackwell semiconductors were “amazing.”

The company’s forecast helps allay doubts around a slowdown in spending on its hardware that emerged last month, following Chinese AI startup DeepSeek’s claims that it had developed AI models rivaling Western counterparts at a fraction of their cost.

Nvidia’s outlook for gross margin in the current quarter was slightly lower than expected, though, as the company’s Blackwell chip rampup weighs on Nvidia’s profit. Nvidia forecast first-quarter gross margins will sink to 71%, below the 72.2% forecast by Wall Street, according to data compiled by LSEG.

Its shares advanced 1% in choppy extended trading, after closing up 3.7% in regular trading. Nvidia is the biggest beneficiary of a rally in AI-linked stocks, with its shares up more than 400% over the last two years.

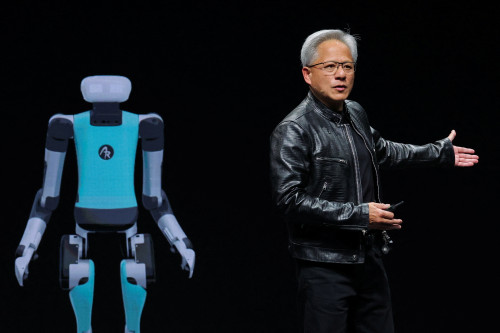

“Demand for Blackwell is amazing,” CEO Jensen Huang said in a statement. “We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter.”

The Santa Clara, California-based company generated $11 billion of revenue from the Blackwell-related products in the fourth quarter, which was roughly 50% of the company’s overall data center revenue, Nvidia’s Chief Financial Officer Colette Kress said in her commentary.

The company expects revenue of $43 billion, plus or minus 2% for the first quarter, compared with analysts’ average estimate of $41.78 billion according to LSEG.

“Despite the breakthroughs from DeepSeek, Nvidia’s momentum with Hyperscalers seems to continue,” Third Bridge analyst Lucas Keh said, referring to large cloud-computing companies.

Chinese companies are ramping up orders for Nvidia’s H20 AI chip due to booming demand for DeepSeek’s low-cost AI model, Reuters reported on Monday.

Demand has grown for Nvidia’s advanced chips that can speedily process the large amounts of data used by generative AI applications, as companies race each other to emerge as leaders of the new technology. Generative AI is a type of artificial intelligence that can learn from data and improve over time.

John Belton, a portfolio manager at Nvidia investor Gabelli Funds, said the forecast “should be a positive read for AI demand and investment cycle.”

This could add fuel to the sputtering AI rally after the Magnificent Seven stocks’ tumultuous retreat from their late-2024 peaks as Wall Street’s optimism waned under the shadow of DeepSeek’s innovations.

Nvidia reported adjusted per-share profit of 89 cents, compared with estimates of 84 cents a share. Revenue for the fourth quarter grew 78% to $39.3 billion, beating estimates of $38.04 billion.

Sales in the data-center segment, which accounts for most of Nvidia’s revenue, grew 93% to $35.6 billion in the quarter ended January 26, above estimates of $33.59 billion. The segment had recorded growth of 112% in the prior quarter.

(Reporting by Max A. Cherney and Stephen Nellis in San Francisco, Arsheeya Bajwa in Bengaluru; Editing by Shounak Dasgupta and Rod Nickel)